Meet Your Anti-Money Laundering Compliance Obligations with Ease

Say Goodbye to Overwhelming Compliance Tasks and Hello to Peace of Mind with SILO Compliance

AML Compliance Doesn't Have to Be Complicated

As a business owner or compliance officer, you know that meeting Anti-Money Laundering (AML) compliance obligations is a critical part of your operations. However, the increasing complexity of AML regulations can be overwhelming, and the cost of hiring additional staff or investing in expensive customized technology solutions can be prohibitive for small and mid-sized firms. That’s where SILO comes in – a Microsoft Azure cloud-based AML compliance management application that helps businesses across different industries meet their AML compliance obligations with ease.

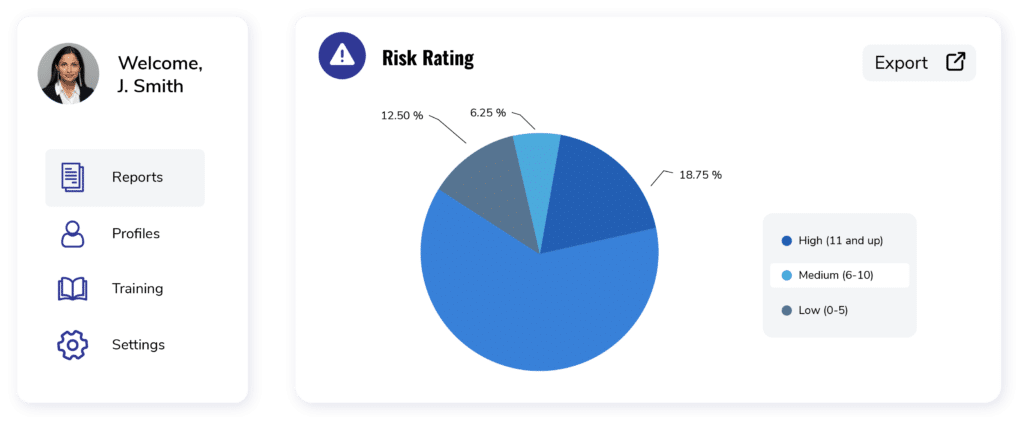

At SILO, we believe that AML compliance doesn’t have to be a burden for you or your business. That’s why we have designed an automated solution that applies a risk-based approach to assist you with gathering client due diligence, performing risk assessments, and training staff. Our user-friendly dashboard, plus email alerts and reminders, notify staff of actions to be taken, ensuring that you meet your compliance obligations on time, every time.

The Effortless AML Compliance Program

With SILO, you can reduce the risk of being used as a conduit for money laundering activities and avoid potential legal and financial penalties for non-compliance with AML regulations. Our user-friendly cloud-based solution can be deployed and configured based on your risk appetite within a few days. Pricing is tiered based on the number of profiles, making it affordable for even small firms.

Automate critical compliance tasks, such as continuous politically exposed persons (PEP) & sanctions monitoring of your clients against sanctions lists and adverse media, saving you time and reducing the risk of compliance errors.

Receive email alerts and reminders when periodic reviews are required on clients, necessary documentation expires, and when enhanced due diligence is needed, ensuring that you meet your compliance obligations on time, every time.

Quickly generate AML-related reports, such as client risk assessments, transaction monitoring reports, and staff training reports, to demonstrate to regulators and auditors how AML compliance obligations were met.

Demonstrate to regulators and auditors who performed specific compliance tasks and when certain processes were followed, reducing the risk of fines and reputational damage.

Keep staff trained on money laundering, terrorist financing, and proliferation financing with ease using SILO’s training feature, which allows you to upload your training presentations, policies, and procedures and create custom quizzes that relate specifically to your business.

Streamline Your Compliance Efforts

During a demo, we’ll show you how a new client is onboarded, risk assessed, and screened against sanctions efficiently, reducing the workload on your staff. We’ll show you how the staff is alerted to expired documents, periodic reviews needed, how management can log their approvals and more.

You’ll see how SILO will help you demonstrate to regulators exactly how you comply with regulations. We can also show you how to use SILO to create and maintain registers of directors, shareholders, and beneficial owners for trust and corporate service providers. For those with FATCA/CRS reporting obligations, we can show you the reports created to help those filing requirements.

Stay Ahead of the Curve with SILO Compliance

Who can benefit from SILO Compliance?

SILO Compliance is ideal for businesses across various industries, including trust and corporate service providers, wealth management firms, banks, cryptocurrency exchanges, and other financial institutions that have AML compliance obligations.

How does SILO Compliance help with AML compliance?

SILO Compliance is a cloud-based AML compliance management application that automates critical compliance tasks, such as gathering and conducting ongoing customer due diligence, performing risk assessments, screening against sanctions and adverse media, and ongoing monitoring of clients. SILO also provides a user-friendly dashboard, email alerts, and reminders to notify staff of actions to be taken. Users can quickly generate various AML-related reports and demonstrate to regulators and auditors how AML compliance obligations were met.

How long does it take to set up SILO Compliance?

SILO Compliance can be deployed and configured based on your risk appetite within a few days.

Is SILO Compliance affordable for small businesses?

Yes, pricing is tiered based on the number of profiles, making it affordable for even small firms.

Is SILO Compliance secure?

Yes, SILO Compliance is a Microsoft Azure cloud-based application that undergoes continuous penetration testing to provide additional comfort in data security.

Interested in Learning More About How SILO Can Fit Your Business?

Schedule a demo of SILO Compliance today and see how it can save you time and resources and help you avoid potential penalties.